2019 Financial Highlights. Money De Ya!

>The Yo-Yo of the Dollar

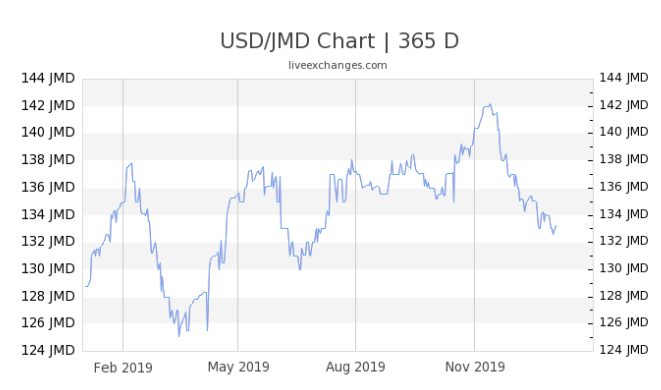

For Jamaicans who earn in the local currency and shop overseas there were periods that caused great distress due to the instability of the exchange rate. According to tradingeconomics.com, the Jamaican Dollar reached its all-time high at $140.53 to $1 USD. Other sources said it was up to $142.23. The Central Bank has since intervened, preventing the dollar from sliding even further and is now back in the low 130s. Phew!

>The IPO Craze

There have been many Initial Public Offerings (IPOs) throughout the year, such as Wigton, LAB, Lumber Depot, Mailpac and First Rock . The IPOs were generally oversubscribed with some closing on their opening day. The Development Bank of Jamaica revealed that 38% of those who invested in Wigton are new investors. While IPOs are not at all new, it seems more people are paying attention.

>The Jamaica Stock Exchange Ranking the Best in the World

At the beginning of 2019, Bloomberg.com named the Jamaica Stock Exchange the best performing stock market in the World. The article by Micheal P Regan spoke about the overperformance of the stock exchange over the last five years and said: “Jamaican stocks have surged almost 300 per cent, more than quadrupling the next-best-performing national benchmark and septupling the S&P 500’s advance.” With only three and a half hours to live trade internationally, this is an impressive feat and title for our island home.

>Abolition of the Minimum Business Tax (MBT)

As of April 1, 2019, specified taxpayers who operate a business, as well as dormant companies, are no longer required to pay the minimum business tax with effect from Year of Assessment 2019. This was a big win for small business owners. Before the abolition of this tax, business owners would have been required to pay $60,000 yearly if they made the ‘prescribed amount’ for the year.

>NCB is a Trillion-Dollar Company

National Commercial Bank (NCB) has more than a trillion dollars worth of assets and is the first listed company to accomplish this feat. They achieved this by the amalgamation of Guardian Holdings Limited, GHL. They upped their stake in the company from 29.99 per cent to 62 per cent. This financial move was what moved their assets to $1.6 trillion. This Jamaican owned and based company continues to outshine and outdo. They are definitely ones to watch in the new year.

As the Jamaican economy grows it is exciting to see what is in store. Jamaicans at home and abroad should definitely take time to seek ways they can invest and contribute to the economic bounceback.