BRICS Pay: Alliance Officially Unveils New Payment System

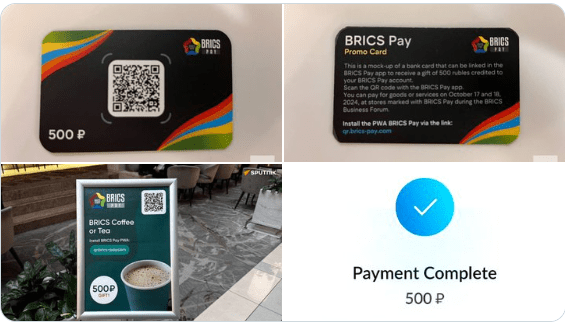

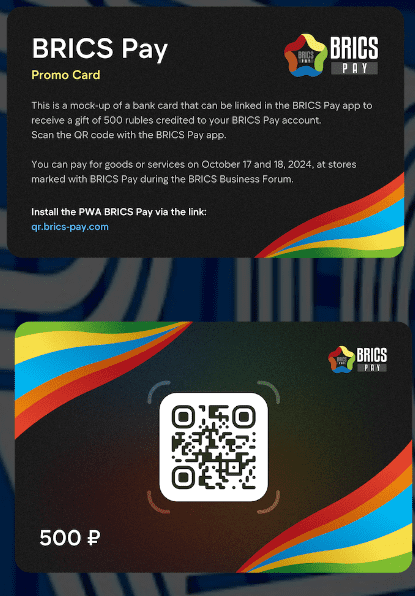

In a significant development for the economic alliance, BRICS Pay has been officially launched. At the BRICS Business Forum occurring in Moscow, attendees were issued new cards for the much-anticipated payment system. These cards mark the inaugural introduction of this landmark initiative.

Russian President Vladimir Putin hosted the summit of BRICS leaders aiming to garner support from the expanded group, which now accounts for approximately one-third of global economic output, amid his ongoing standoff with Western nations.

The 16th summit is scheduled to be held in the Kazan region of Russia from October 22 to 24. Russia has indicated that the summit will be attended by leaders from Brazil, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates. Additionally, Saudi Arabia, which has received an invitation to join, will be represented by its foreign minister.

The bloc’s BRICS Pay system has officially been unveiled at the collective’s Business Forum in Moscow. Those who participate in the event have received a demo version of the payment system card. They have been giving funds to spend through the blockchain-based system.

What is BRICS? BRICS is an acronym for the powerful grouping of the world’s leading emerging market economies, namely Brazil, Russia, India, China and South Africa. The BRICS mechanism aims to promote peace, security, development and cooperation.

The BRICS Pay system was a joint venture between the BRICS states to receive and make payments in their own local currencies. The venture was launched in 2018 by the BRICS Business Council.

BRICS mBridge will serve as a gateway for settlements in central bank digital currencies (CBDs). Effectively, it will act as an alternative to today’s most commonly used payment platform, called Society for Worldwide Interbank Financial Telecommunication (SWIFT) system.

BRICS Pay represents an alternative payment system utilizing the national currencies of BRICS member states. This innovative framework will incorporate a new messaging system alongside a network of national commercial banks interconnected through the central banks of BRICS, thereby eliminating the necessity for currency exchange through the U.S. dollar.

The proposed system will be resilient against external pressures and will leverage blockchain technology to securely store and transfer digital tokens, which will be backed by national currencies. This approach aims to enhance security and diminish transaction costs. The overarching objective is to ensure the seamless continuation of trade flows among member countries, even in the event that one or more members are excluded from the international financial system.

BRICS Pay serves as an international settlement and depository infrastructure, which the Russian government posits will significantly enhance cross-border trade in national securities. This initiative aims to ensure that all member states maintain full access to BRICS financial markets, even in circumstances where they may be excluded from Western financial systems.

Additionally, the proposal includes the establishment of a BRICS reinsurance company. This entity would facilitate the uninterrupted shipment of goods and essential commodities among member nations, particularly in instances where Western reinsurance firms, which currently dominate international trade, may decline to extend their services.

Russia’s President Vladimir Putin has announced that 35 new countries will participate in the upcoming BRICS summit. The alliance, now comprising nine members, will engage in discussions focused on de-dollarization, the revision of trade policies, and the preference for local currencies in cross-border transactions.

The 35 emerging economies set to participate in the BRICS 2024 summit have expressed their readiness to drop the US dollar for trade purposes. They intend to utilize their native currencies for financial settlements, thereby enhancing their Gross Domestic Product (GDP) and supporting local businesses. The sanctions imposed by the United States on Russia in 2022 in response to conflict with Ukraine have instilled apprehension among developing nations that their own economies may be at risk.

Even US Treasury Secretary Janet Yellen has acknowledged that the White House’s push for sanctions has contributed to the de-dollarization efforts among developing nations. Members of BRICS, particularly Russia and China, have capitalized on this situation, persuading other countries to reduce their reliance on the US dollar. Over the past two years, Russia and China have successfully encouraged several nations to join the movement toward de-dollarization.

Emerging economies currently remain on the sidelines but may consider participating in this initiative following the BRICS 2024 summit. Such developments could impose significant pressure on the US dollar, altering its position within global supply and demand dynamics. Consequently, the upcoming summit may prove pivotal in determining the future of the USD, as emerging economies might begin to sever their financial ties with it.